A month relatively uninterrupted by extreme weather events enabled consumers across New Zealand to get out and increase their spending in March, but retail conditions remain challenging, says Worldline NZ.

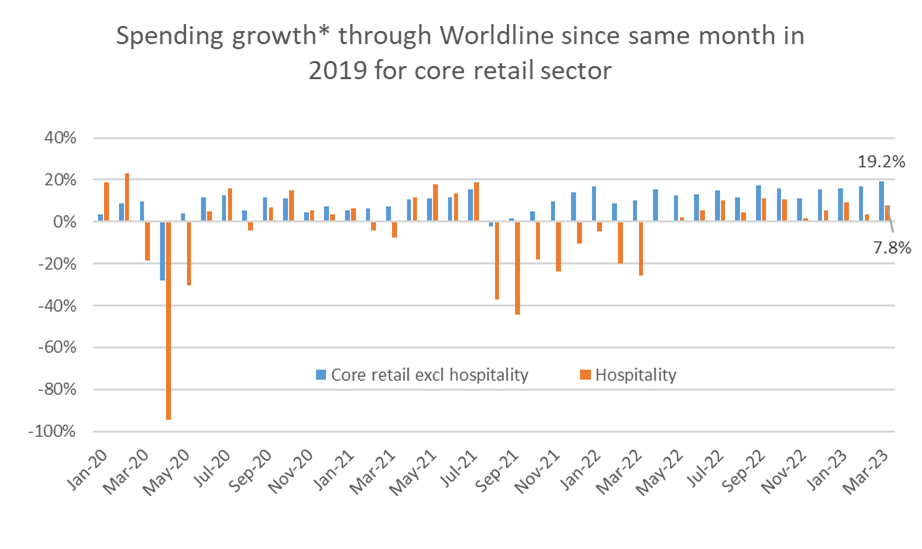

Consumer spending in March 2023 through Core Retail merchants (excluding Hospitality) in Worldline NZ’s payments network reached $3.138B, which is up 8.3% on March 2022 and up a record 19.2% on the same month in 2019.

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says while March was noteworthy for its relative ‘normality’ following the storms that impacted the country in January and February, this doesn’t provide the full picture for rises in consumer spending.

“March 2023 saw the highest level of growth in spending – 19.2% – since 2019, before Covid, surpassing the 17.3% growth level reached in September 2022. Ongoing increases in spending from one year in the past would usually be considered normal, as growth in income and prices feed through the retail sector, but this has not been so lately. Events such as Covid-19 and the more recent storms have disrupted spending patterns repeatedly over the last 3-4 years.”

Figure 1: All Cards NZ underlying* spending growth through Worldline Core Retail merchants since the same month in 2019 (* Underlying excludes large clients moving to or from Worldline)

“Still, while an uninterrupted March was no doubt a relief to many merchants – and people in general – there are still many signs of a challenging retail market,” says Proffit.

Proffit says the 19.2% growth since 2019 is barely above the inflation rate seen since March quarter 2019 and, now, the ‘big-ticket’ sectors are experiencing a noticeable decline in card spending on an annual basis.

“Merchant groups such as hardware stores, furniture shops and appliances outlets all posted spending in March 2023 that was above spending in March 2019, but spending in these groups has actually fallen since March 2022,” says Proffit.

“The Hospitality sector is also showing promising returns to pre-Covid spending patterns, albeit the four-year growth rate is even further below the inflation rate. However, the 7.8% growth since March 2019 occurred on the second busiest month of the year for the sector. More compelling evidence of improving times for Hospitality merchants is the 45% growth since March 2022.”

Proffit says the mixed patterns are also evident from the latest regional figures.

“Auckland/Northland was one of the regions to see a new high in post-2019 growth rates for Core Retail (excluding Hospitality) at 15.5%, but this is below the inflation rate. The 4-year growth rate was even lower in Wellington and Otago.”

For the record, the March regional figures show annual Core Retail (excluding Hospitality) spending growth (ie, 2022 to 2023) were highest – in percentage terms – in Otago (+17.3%), West Coast (+14.6%) and Marlborough (+14.1%). Annual spending growth was lowest in Wellington (+4.4%).

| WORLDLINE All Cards underlying* spending for CORE RETAIL less HOSPITALITY merchants for March 2023 | |||

| Region | Value transactions $millions | Underlying* Annual % change on 2022 | Underlying* Annual % change on 2019 |

| Auckland/Northland | 1,150 | 8.3% | 15.5% |

| Waikato | 250 | 7.8% | 27.2% |

| BOP | 209 | 7.1% | 22.9% |

| Gisborne | 28 | 9.6% | 19.5% |

| Taranaki | 72 | 6.4% | 33.5% |

| Hawke’s Bay | 113 | 9.7% | 26.7% |

| Whanganui | 39 | 7.4% | 32.7% |

| Palmerston North | 96 | 7.7% | 29.7% |

| Wairarapa | 39 | 5.8% | 31.1% |

| Wellington | 294 | 4.4% | 13.2% |

| Nelson | 64 | 9.6% | 20.7% |

| Marlborough | 39 | 14.1% | 19.1% |

| West Coast | 23 | 14.6% | 28.7% |

| Canterbury | 372 | 7.8% | 24.0% |

| South Canterbury | 53 | 8.6% | 25.3% |

| Otago | 175 | 17.3% | 15.1% |

| Southland | 77 | 11.4% | 22.8% |

| New Zealand | 3,138 | 8.3% | 19.2% |

Figure 2: All Cards NZ underlying* spending through Worldline in March 2023 for core retail excluding hospitality merchants around (* Underlying excludes large clients moving to or from Worldline)