Shoppers paid less at the checkout for cheese, butter and ice cream at Foodstuffs stores in December, and many veggies were down over 30%. But there’s now growing potential for inflationary headwinds due to tensions in the Middle East.

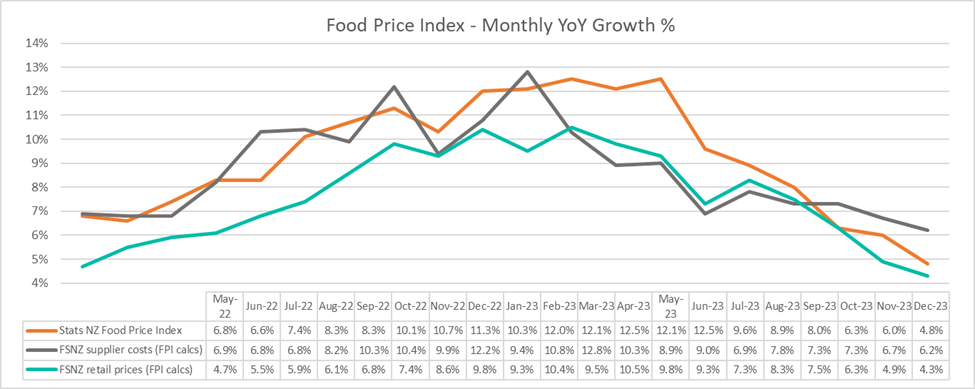

Latest data from Stats NZ and Foodstuffs shows a continued decline in the rate of food price inflation in New Zealand. Stats’ Food Price Index (FPI), which tracks the price of a representative basket of goods from retailers around the country, shows food prices rose 4.8%pa in December, compared to year ago.

By comparison, Foodstuffs’ data on the same categories as the FPI basket shows prices at the Co-ops’ 500+ stores were up 4.3%pa in December, on average, compared to a year ago.

Foodstuffs NZ Managing Director Chris Quin says having both statistics under 5% for the first time in two years is a positive sign for the year ahead. “This was a good way to end 2023: another decline in the official rate of food inflation overall, and another month where locally owned Foodstuffs stores achieved a lower average rate than that, by being efficient and buying well on behalf of customers,” says Quin.

“It bodes well for 2024, with experts widely predicting inflation to fall further, but that optimism should be tempered by the risk of geopolitical tensions once again disrupting supply, as is now happening in the Middle East.”

Big declines in some dairy, veggies, treats in December

Data from the Foodstuffs Co-ops’ 500+ locally owned stores shows 1kg blocks of Pams cheese were down by 14%, on average, compared to December 2022, while Pams 500g blocks of butter were down 16%.

But the biggest year-on-year falls were once again in the produce department, with prices for courgettes and tomatoes plummeting by 52% and 43%, respectively, while avocados were down 38% and capsicums down 31%. Other double-digit price declines included celery, broccoli, cauliflower, cucumber and lettuce.

“Plenty of sunshine has meant good supply of produce this summer, letting us buy well and offer sharper prices. Our produce teams are seeing that continue into January,” says Quin.

Stone fruit season continues and New Zealand watermelon, rock melon and cherries are peaking now too. January is the main season for sweetcorn, and new season kumara and apples are arriving instore soon, after both were devastated by last year’s cyclones.

New Zealand’s favourite summer treat – ice cream – was also more affordable in December, with 2L tubs down 15%, on average, across Foodstuffs stores nationwide.

“On the flipside, our produce teams say some imported fruits have been harder to source and therefore more costly. Grapes have been short since California was hit by a hurricane last August. Thankfully the Australian grape season is underway – allowing us to buy them closer to home.”

Middle East tensions could affect imports in January

The impact of offshore events on food imports is also being felt due to tensions in the Middle East. Container ships using the Suez Canal and Red Sea are being attacked, forcing them to reroute around South Africa, adding weeks to travel times and extra costs per container.

The potential impact was noted in Infometrics’ Grocery Supplier Cost Index (GSCI) Update for December. The Infometrics-Foodstuffs NZ GSCI recorded an average 4.5%pa rise in the list cost of 60,000 products supplied to Foodstuffs – significantly less than the 6.2%pa rise in supplier charges for products in the same categories as Stats’ FPI basket.

Infometrics noted that shipping costs had edged slightly higher over December before nearly doubling in the first week of January, as the Red Sea attacks stepped up.

Chris Quin says the Foodstuffs’ team have been working hard to mitigate any potential impact here.

“We’re seeing increases in shipping costs due to the longer voyage times, but to date we haven’t seen an impact on stock levels because the time it takes to bring goods in from Europe and North Africa is longer than the time this crisis has been having a notable impact on freight,” Quin says.

“Our teams are busy placing orders to replenish stock earlier than usual, to pre-empt potential supply gaps. This will mean extra storage and capital costs for us, on top of the extra freight charges – but we currently have no plan to pass those on, as they’ll hopefully be short-lived.”

Quin says Foodstuffs’ ability to confidently respond to such events shows the value in having a strong NZ-owned grocery retailer in this country.

“In times of crisis, we use our offshore networks and bulk buying power to ensure New Zealanders get the supplies they need. The fact we’ve been doing that for over a century, and repeatedly through times of strife, is a New Zealand business success story,” he says.

Graph: Foodstuffs analysis against Stats NZ data (May 2022 – Dec 2023)